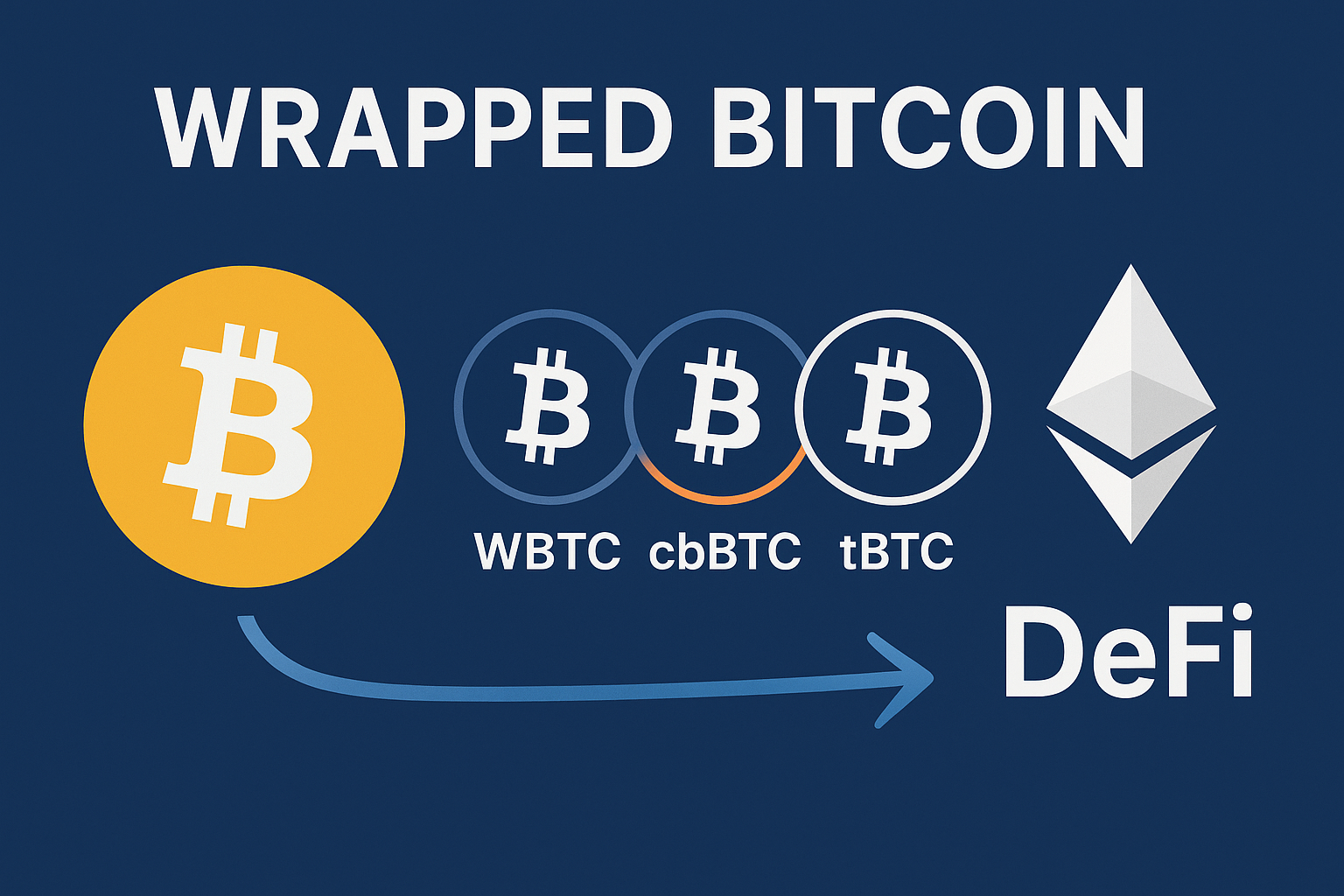

Bitcoin is the largest and most well-known cryptocurrency, but it wasn’t built with decentralized finance (DeFi) in mind. Most DeFi protocols live on Ethereum or other smart contract blockchains, which means Bitcoin cannot be used directly in these systems. Wrapped Bitcoin (WBTC) and other wrapped BTC tokens were created to bridge that gap.

In this article, we’ll break down what Wrapped Bitcoin is, how it works, why people use it, and compare different versions like WBTC, cbBTC, and tBTC.

What is Wrapped Bitcoin (WBTC)?

Wrapped Bitcoin (WBTC) is a tokenized version of Bitcoin that exists on Ethereum and other smart contract blockchains.

-

1 WBTC = 1 BTC (pegged 1:1).

-

It’s an ERC-20 token, meaning it can interact seamlessly with Ethereum-based DeFi protocols.

-

WBTC is backed by actual Bitcoin, which is held in reserve by a network of custodians.

Think of it as a “bridge asset” that represents Bitcoin in ecosystems where Bitcoin itself cannot natively function.

Other Types of Wrapped BTC

While WBTC is the most widely used version, other wrapped Bitcoin projects have emerged to address concerns about centralization and trust.

1. Coinbase Wrapped BTC (cbBTC)

-

Issued by Coinbase as a part of its Base ecosystem.

-

Pegged 1:1 with BTC, but custody is handled by Coinbase.

-

Designed to make Bitcoin accessible in Ethereum Layer 2 and DeFi protocols.

-

Centralized, but backed by Coinbase’s regulated infrastructure.

2. Threshold BTC (tBTC)

-

A decentralized alternative to WBTC.

-

Backed by Bitcoin held in a network of decentralized signers, rather than a single custodian.

-

Focused on reducing trust in centralized institutions.

-

Available on Ethereum and other chains, with growing adoption in DeFi.

3. Bitcoin BEP2 (BTCB)

-

Issued by Binance as part of its BNB Chain ecosystem.

-

The 1:1 peg is maintained by holding Bitcoin in auditable Binance reserve wallets

- Bridges Bitcoin’s liquidity into the BNB Chain for DEX trading and DeFi protocols

- Centralization simplifies auditing but exposes holders to counterparty risk linked to Binance’s financial stability.

Why Use Wrapped BTC in DeFi?

Wrapped Bitcoin, in all its forms, gives BTC holders access to opportunities not available on the Bitcoin blockchain itself.

-

Access to DeFi protocols

-

Lending and borrowing on platforms like Aave or Compound

-

Yield farming and liquidity provision

-

Trading on decentralized exchanges (DEXs)

-

-

Collateral for Loans

-

Use WBTC, cbBTC, BTCB, or tBTC as collateral to borrow stablecoins.

-

-

Liquidity

-

Wrapped BTC tokens bring Bitcoin’s liquidity to DeFi ecosystems, helping trading and lending markets function more efficiently.

-

-

Interoperability

-

Bridges allow wrapped BTC to move across different blockchains (Ethereum, Base, Layer 2s), giving BTC holders more flexibility.

-

Risks of Wrapped BTC

No matter which version you use, wrapped BTC carries certain risks:

1. Custodial Risk

-

WBTC, cbBTC or BTCB rely on centralized custodians. If they fail, reserves could be at risk.

2. Centralization vs. Decentralization Trade-off

-

WBTC, cBTC and BTCB are highly liquid but centralized.

-

tBTC is decentralized but less widely adopted, which may affect liquidity.

3. Smart Contract Risk

-

All wrapped BTC tokens depend on smart contracts that could be vulnerable to bugs or exploits.

4. Bridge Risk

-

Moving wrapped BTC across chains requires bridges, which have historically been targets for hacks.

Final Thoughts

Wrapped Bitcoin is a powerful tool that unlocks DeFi opportunities for Bitcoin holders. Each version has trade-offs:

-

WBTC – Most liquid, widely adopted, but centralized.

-

cbBTC or BTCB – Backed by large exchanges (Coinbase / Binance), secure but fully centralized.

-

tBTC – Decentralized, trust-minimized, but still growing in liquidity.

For investors, the choice often comes down to whether you prioritize liquidity and convenience (WBTC/cbBTC/ BTCB) or decentralization and trust minimization (tBTC).

As with all DeFi activities, balancing rewards with risks is key.